Conductiv Partners with MeridianLink to Accelerate Market Momentum and Enable Financial Institutions to Increase Loan Approval Rates and Serve More Consumers

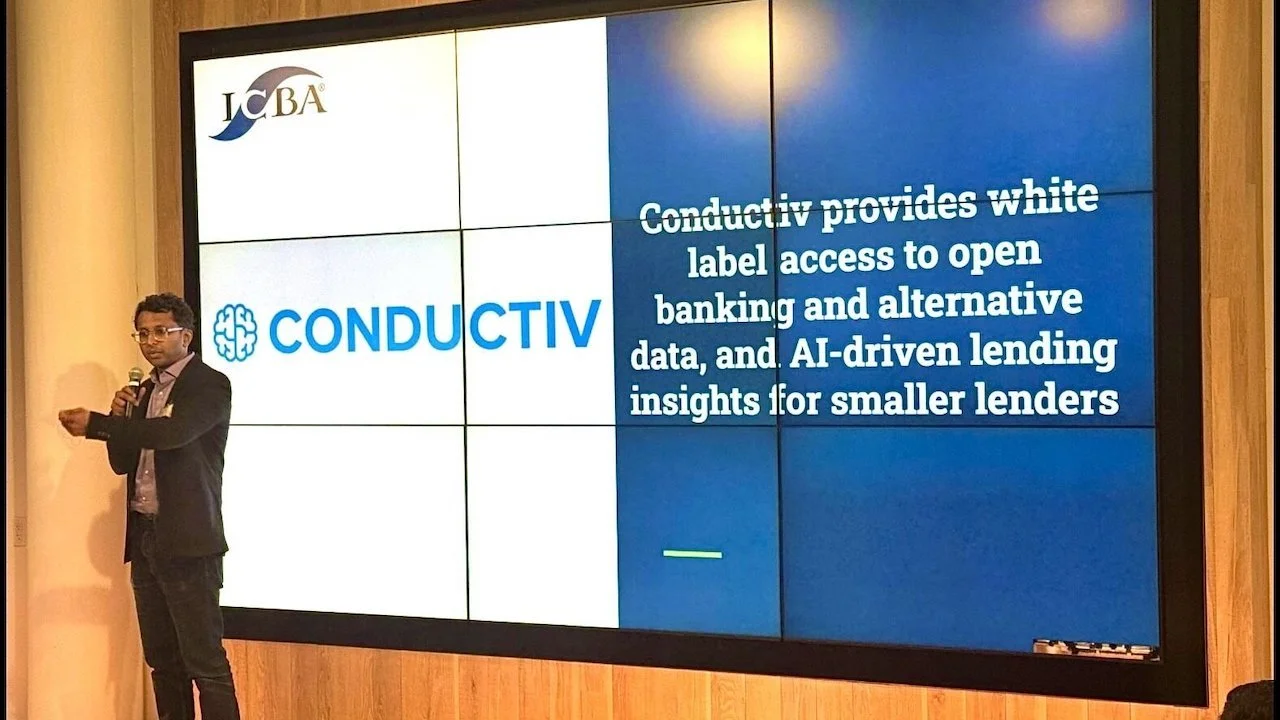

Conductiv, Inc, the leader in providing missing, permissioned data and transforming data to meet underwriting guidelines, today announced its partnership with MeridianLink, Inc.(NYSE: MLNK), a leading provider of modern software platforms for financial institutions and consumer reporting agencies. The partnership allows banks and credit unions to access alternative data to approve more loans and serve more consumers. Through the integration, shared customers can leverage machine learning and data science to transform consumer lending.

Combining the strength of the MeridianLink® Consumer lending platform with access to missing, permissioned data empowers lenders to efficiently and confidently approve more loans, open more deposits, and deliver better, faster, and fairer lending to consumers.